Condo Insurance in and around San Diego

Unlock great condo insurance in San Diego

Quality coverage for your condo and belongings inside

Calling All Condo Unitowners!

Are you investing in condo ownership for the first time? Or have you been around the block a few times? Either way, it can be a good idea to get coverage for your condo with State Farm's Condo Unitowners Insurance.

Unlock great condo insurance in San Diego

Quality coverage for your condo and belongings inside

Why Condo Owners In San Diego Choose State Farm

With this insurance from State Farm, you don't have to be afraid of the unpredictable happening to your condo and its contents. Agent Gio Monaco can help provide all the various options for you to consider, and will assist you in creating a wonderful policy that's right for you.

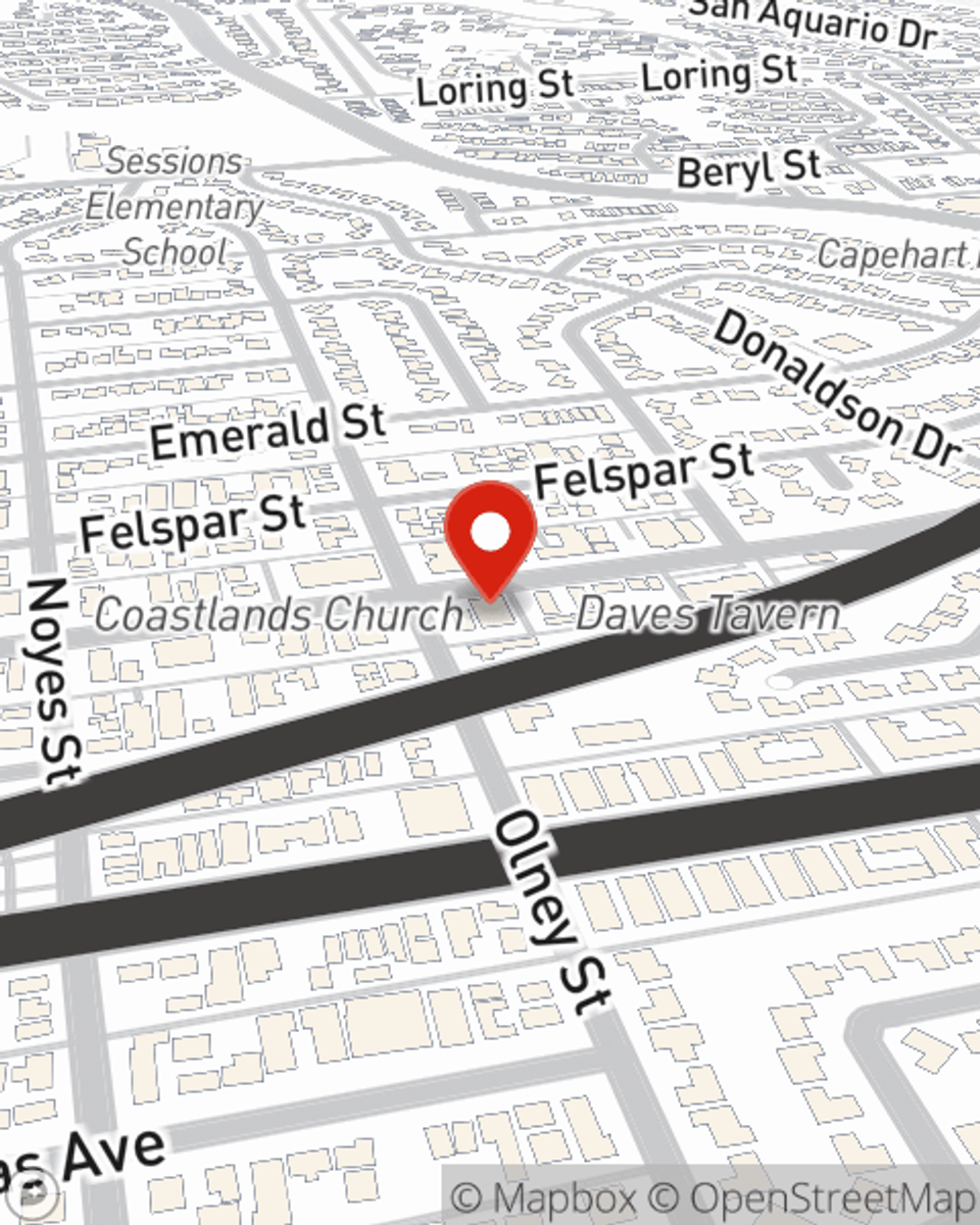

Getting started on an insurance policy for your condominium is just a quote away. Get in touch with State Farm agent Gio Monaco's office to discover your options.

Have More Questions About Condo Unitowners Insurance?

Call Gio at (858) 272-2343 or visit our FAQ page.

Simple Insights®

10 Washing machine maintenance tips

10 Washing machine maintenance tips

Routine washer maintenance can help reduce breakdowns and costly water damage. Learn how to clean your washing machine and more.

How to deal with noisy neighbors or issues

How to deal with noisy neighbors or issues

From noisy neighbors and arguments over property lines to adventurous pets, there are ways to successfully resolve disputes between neighbors.

Simple Insights®

10 Washing machine maintenance tips

10 Washing machine maintenance tips

Routine washer maintenance can help reduce breakdowns and costly water damage. Learn how to clean your washing machine and more.

How to deal with noisy neighbors or issues

How to deal with noisy neighbors or issues

From noisy neighbors and arguments over property lines to adventurous pets, there are ways to successfully resolve disputes between neighbors.